When “Sorry for the inconvenience” Isn’t Enough

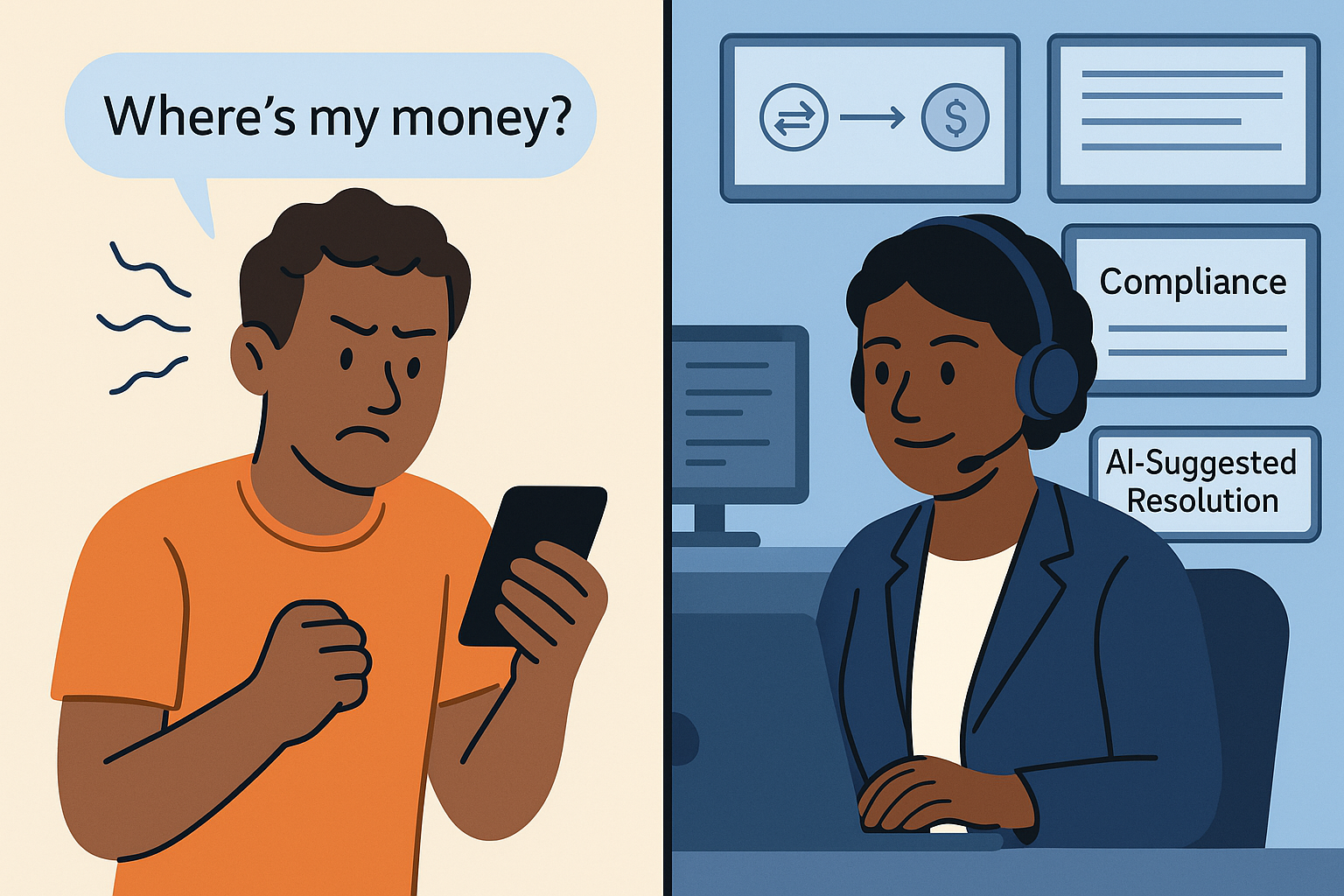

In the fast-evolving world of fintech, a support agent’s role goes far beyond reading scripts and submitting tickets. These aren’t just customer complaints — they’re financial anxieties, transactional breakdowns, or security concerns that directly affect people’s trust and livelihood.

When someone’s investment dashboard won’t load or a cross-border transfer goes missing, a robotic response isn’t just ineffective — it’s damaging.

Your support team is more than just a helpdesk.

They are the voice of your brand. And in fintech, that voice must be fluent in both technology and finance.

The Dual Challenge: Technical Fluency Meets Financial Literacy

Building a support team for a fintech product is complex because the users are navigating two domains:

The Tech Side:

The Finance Side:

To deliver effective support, agents must understand both. One without the other creates blind spots — and frustrated users.

What Happens When Support Isn’t “Financially Aware”?

Here’s what we’ve observed from failed support cases across the ecosystem:

In each of these cases, the issue isn't just unresolved — it's escalated emotionally. And in fintech, emotional frustration often turns into brand abandonment.

What the Ideal Fintech Support Agent Looks Like

Here’s what we believe support agents for fintechs should be trained in:

✅ Tech-Savvy Fundamentals

✅ Financial Knowledge

✅ Human-Centric Soft Skills

Azanah’s Approach: Human First, Expert Always

At Azanah Support, we’ve built a model that prioritizes this exact skillset. Whether we’re supporting an African neobank, a European crypto wallet, or a micro-lending platform, our approach is designed to bridge the knowledge gap.

Here’s how we do it:

We’re not just support agents.

We’re tech-fluent, finance-aware, human-first partners for your growth.

Final Thoughts: The New Standard of Fintech Support

In a space as sensitive and high-stakes as fintech, support isn’t a “nice to have.” It’s the core of your customer experience.

If you’re serious about retention, compliance, and user trust —

you need a support team that understands your product, your users’ pain points, and the ecosystem you operate in.

And that support team?

Should speak fluent tech, fluent finance, and fluent empathy. Want to build your dream support team? Get started

In the fast-evolving world of fintech, a support agent’s role goes far beyond reading scripts and submitting tickets. These aren’t just customer complaints — they’re financial anxieties, transactional breakdowns, or security concerns that directly affect people’s trust and livelihood.

When someone’s investment dashboard won’t load or a cross-border transfer goes missing, a robotic response isn’t just ineffective — it’s damaging.

Your support team is more than just a helpdesk.

They are the voice of your brand. And in fintech, that voice must be fluent in both technology and finance.

The Dual Challenge: Technical Fluency Meets Financial Literacy

Building a support team for a fintech product is complex because the users are navigating two domains:

The Tech Side:

- App crashes

- API errors

- Login authentication

- Multi-factor security bugs

The Finance Side:

- Failed transactions

- Account verifications (KYC/AML)

- Refunds, chargebacks, and payout issues

- Tax reports, balance clarifications

To deliver effective support, agents must understand both. One without the other creates blind spots — and frustrated users.

What Happens When Support Isn’t “Financially Aware”?

Here’s what we’ve observed from failed support cases across the ecosystem:

- A user reports a payment issue, and the support agent doesn’t understand settlement cycles or intermediary bank delays.

- A customer disputes a failed charge, but the agent doesn't understand the difference between “authorized,” “settled,” and “cleared.”

- A digital wallet user asks about transfer limits, and the agent refers them to FAQs without explaining the compliance behind it.

In each of these cases, the issue isn't just unresolved — it's escalated emotionally. And in fintech, emotional frustration often turns into brand abandonment.

What the Ideal Fintech Support Agent Looks Like

Here’s what we believe support agents for fintechs should be trained in:

✅ Tech-Savvy Fundamentals

- Understanding how the app works from backend to front-end

- Familiarity with APIs, user flows, log troubleshooting

- Ability to interpret logs and error codes to some degree

✅ Financial Knowledge

- Grasping how payments, refunds, wallets, loans, etc., work

- Understanding financial terms, transaction delays, gateways

- Awareness of regulatory bodies (KYC, AML, PCI-DSS) and what they mean

✅ Human-Centric Soft Skills

- Empathy for financial stress

- Clear communication, especially with non-tech-savvy users

- Ability to de-escalate frustration with reassurance, not delay

Azanah’s Approach: Human First, Expert Always

At Azanah Support, we’ve built a model that prioritizes this exact skillset. Whether we’re supporting an African neobank, a European crypto wallet, or a micro-lending platform, our approach is designed to bridge the knowledge gap.

Here’s how we do it:

- Dual Training Programs: All our support agents are trained in both customer service best practices and fintech basics.

- AI-Assisted Workflows: Internally, we use AI tools to surface critical data, reduce handling time, and empower agents with context before they even respond.

- Tiered Specialization: Level 1 handles common tech-finance issues; Level 2 manages edge cases, integrations, or more advanced troubleshooting.

- Scalable, Flexible Support Models: Whether you're a 3-person founding team or a Series A rocketship, we match your growth stage with the right level of support.

We’re not just support agents.

We’re tech-fluent, finance-aware, human-first partners for your growth.

Final Thoughts: The New Standard of Fintech Support

In a space as sensitive and high-stakes as fintech, support isn’t a “nice to have.” It’s the core of your customer experience.

If you’re serious about retention, compliance, and user trust —

you need a support team that understands your product, your users’ pain points, and the ecosystem you operate in.

And that support team?

Should speak fluent tech, fluent finance, and fluent empathy. Want to build your dream support team? Get started

© 2023 All rights reserved.

DMCA PROTECTED

DMCA PROTECTED

.

.